capital gains tax increase date

An immediate effective date would prevent taxpayers from selling assets and engaging in transactions ahead of the rate increase. If we conservatively use October 15 2021 as the effective date of the tax rate increase any tax-advantaged MSR trade would need to have a sale date of 9302021.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital gains tax rates on most assets held for a year or less.

. With tax writers launching mark-ups as early as Sept. 9 and racing against a Sept. The tax rate on most net capital gain is no higher than 15 for most individuals.

April 23 2021 Garrett Watson Erica York President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent today to 396 percent for higher earners. April 27 2021 Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets.

How and when CGT is triggered such as when an asset is sold lost or destroyed. Implications for business owners. Ad The Leading Online Publisher of National and State-specific Legal Documents.

Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widow er. The proposed capital gains tax reforms of which any Budget. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987 and by 40 in 2012 in anticipation of the increased maximum tax rate from 15 to 25 in 2013. This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. In 2022 individual filers wont pay any capital gains tax if their total taxable income is 41675 or less.

Capital gains tax is likely to rise to near 28 rather than 396 as Joe Biden plans Goldman said. The bank said razor-thin majorities in the House and Senate would make a big increase difficult. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28.

Hawaiis capital gains tax rate is 725. The House proposes that its capital gains increase apply to sales on or after Sept. Get Access to the Largest Online Library of Legal Forms for Any State.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Additionally the change to 25 could be effective as of the date. There is currently a bill that if passed would increase the.

Were going to get rid of the loopholes that allow Americans who make more. Understanding Capital Gains and the Biden Tax Plan. 13 2021 unless pursuant to a written binding contract effective on or before Sept.

Capital Gain Tax Rates. 27 deadline there could be imminent action triggering an effective date tied to an upcoming date. Youll owe either 0 15 or 20.

The rate jumps to 15 percent on. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. Capital gains tax rates on most assets held for a.

In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million starting in. Currently the capital gains rate is 20 for single taxpayers with income over 441451 and for taxpayers who are married filing jointly with income over 496601. Check if your assets are subject to CGT exempt or pre-date CGT.

The Chancellor will announce the next Budget on 3 March 2021. 4 rows The proposal would increase the maximum stated capital gain rate from 20 to 25. Establish the date you buy or acquire an asset your share of ownership and records to keep.

The capital gains tax on most net gains is no more than 15 for most people. There have been two major increases in the tax rate applicable to long-term capital gains in the past 50 years. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions.

This percentage will generally be less than your income tax rate. Most likely the actual long-term capital gains tax increase will be agreed to in reconciliation of the infrastructurestimulus bill this coming fall. This resulted in a 60 increase in the capital gains tax collected in 1986.

If we conservatively use. Long-Term Capital Gains Taxes. If you sell small-business stocks or collectibles the maximum capital gains tax rate.

Many speculate that he will increase the rates of capital gains tax to help raise cash necessary to recoup the public costs arising as a result of the COVID-19 pandemic. If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0. As of 2021 the long-term capital gains tax is typically either 0 15 or 20 depending upon your tax bracket.

Unlike the long-term capital gains tax rate there is no 0. That applies to both long- and short-term capital gains. A capital gain rate of 15 applies if your taxable income is.

In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987.

Capital Gains Tax What Is It When Do You Pay It

How To Save Capital Gain Tax On Sale Of Residential Property

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Tax Advantages For Donor Advised Funds Nptrust

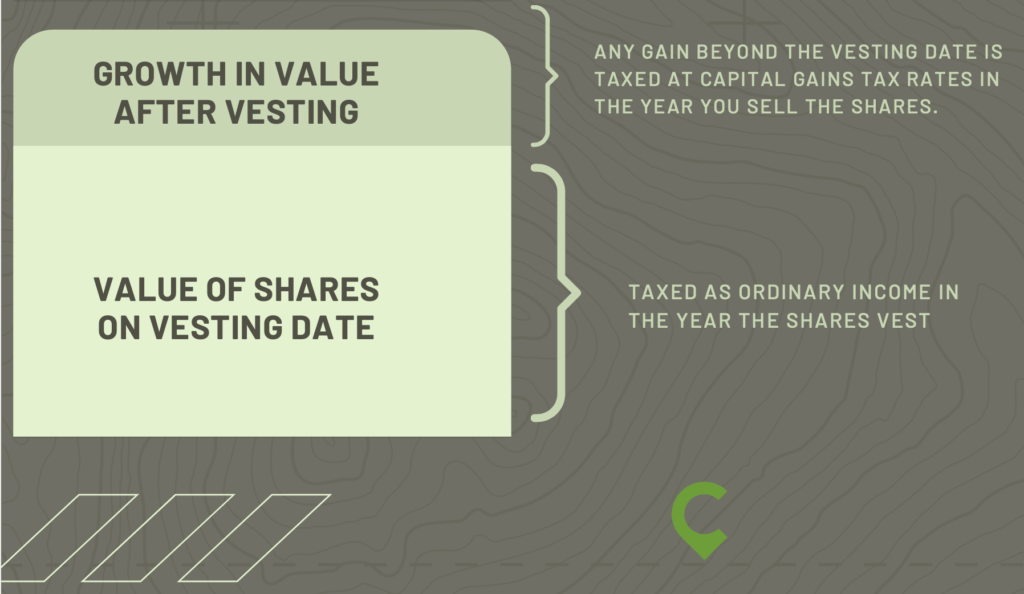

Rsu Taxes Explained 4 Tax Strategies For 2022

How Much Is Capital Gains Tax On Real Estate Plus How To Avoid It

2021 Capital Gains Tax Rates By State

Capital Gains Tax What Is It When Do You Pay It

Rsu Taxes Explained 4 Tax Strategies For 2022

Pin By Dua Financial Fmp Bonds Els On Dua Capital Tax Free Investments Taxact Investing

How To Calculate Capital Gains Tax H R Block

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

2022 Capital Gains Tax Rates By State Smartasset

:max_bytes(150000):strip_icc()/1099-DIV-ffc2266fbad34acd9de5359089733572.jpg)